Many manufacturers may also find that management software can augment their accounting solution to help them with what’s halfway house project management from design to distribution. Enterprise resource planning (ERP) software can automate many aspects of your business, including finance, human resources, customer relationship management (CRM), marketing, and more. However, an ERP system can also be pricey, especially for small manufacturers or startups. This method considers numerous future costs that might impact the final cost of producing the product.

You might find all these features – or rather, all the ones you need – in a single system. But in many cases, single-vendor how to calculate the break software that offers near-unlimited features can be overwhelming or inefficient. Your building lease is most likely a fixed cost because, regardless of what you do inside the building, the lease usually stays the same.

Manufacturing accounting: A unique approach for a unique sector

Sage makes no representations or warranties of any kind, express or implied, about the completeness or accuracy of this article and related content. As part of the manufacturing process, your business is likely to have items in production that have not yet been completed. In this guide we’ll walk you through the financial statements every small business owner should understand and explain the accounting formulas you should know.

Direct labor

Effective inventory management not only minimizes disbursement but also enhances operational efficiency and increases profitability. Manufacturing accounting systems offer valuable visibility into key aspects of inventory management, encompassing goods acquisition, stock valuation, and the calculation of moving average costs (MAC). These insights enable businesses to optimize their inventory management strategies and achieve a more streamlined and profitable manufacturing process. Production costing methods are manufacturing accounting methods used to calculate and analyse your costs to produce finished goods. In production management, manufacturing cost accounting seeks to determine the cost of goods sold to better understand revenue and profitability at both the business level and controllers career guide the individual product level.

Manufacturing accounting software

It can be more difficult to implement than standard or job costing, however, as a more detailed overview is required over the manufacturing process. The job order costing method calculates costs per manufacturing project or unit, making it useful for make-to-order manufacturers, construction manufacturers, and the like. It is based on calculating standard rates for the direct and indirect costs of products. These predetermined “standards” are usually based on the company’s previous experiences and are routinely updated to reflect market fluctuations. Variable costs are expenses that a company bears proportional to its production volume.

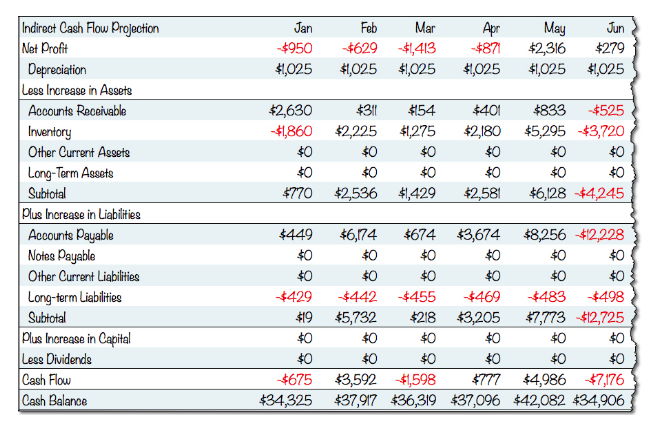

The accounting for a manufacturing business deals with inventory valuation and the cost of goods sold. These concepts are uncommon in other types of entities, or are handled at a more simplified level. You need accurate financials to correctly forecast cash flow and ensure you’re paying the right amount of taxes. And the efficiency with which you perform accounting for manufacturing directly impacts your bottom line. Spreadsheets may work for smaller businesses, but the more complex your operations become, the better it will be to have a tool that can automate most of the accounting processes.

- This means that the inventory valuation in the accounting records will be inaccurate, except when a physical count is performed.

- There are likely hundreds of software tools available that help with accounting for manufacturing costs.

- By integrating your accounting software with Katana’s cloud manufacturing platform, you’ll get all these essential features and more.

- Here are some best-practice tips for conducting successful manufacturing accounting.

- Rather than a one-and-done approach, monitor and regularly review the effectiveness of your current processes.

Manufacturing companies often use data from the manufacturing accounting process to compile compliant financial reports. Capable inventory management and MRP software systems also automatically compile manufacturing accounting data into readily usable reports. The direct costs are often traceable to the creation of the product and the maintenance of low variability in the overheads allows businesses to ensure a healthy margin of profit. Your cost of goods manufactured includes all direct and indirect costs that go into the products you finish producing during an accounting period. Like the cost of goods sold, it generally refers to direct materials, direct labor, and manufacturing overhead.

Variable costs are any production costs that change as you produce more or fewer items. For example, raw materials are typically variable because more materials are required to produce more items. Having a manufacturing account includes increased efficiency, better cash flow management, informed decision-making, and improved financial planning. The Manufacturing account can be used by businesses that produce products or goods. It is a tool that companies can use to help manage the finances and inventory of a manufacturing company. Small manufacturers and new manufacturing businesses need easy-to-use, intuitive accounting software that they can set up quickly.